PensionBee Review 2025: Best Self Employed Pension for Your Money

Read my PensionBee Review to see why I decided to set up a self employed pension with them, and why I think they’re the best option for us creatives and travellers.

*This Pension Bee review is totally independent and I’ve spent a lot of time researching a decision I plan to stick with for life.

Sorting out a self employed pension had been on my to do list for about five years. This, my 36th year, was the year I was determined to make it happen, and just in time for the end of the tax year, too.

As I looked into the state pension situation in England more, I realised that I should absolutely start saving now. In the past I’d heard that a lot, looked into it, decided it was too much hassle, and moved on with my life. I kept telling myself that I owned my house so I’d be fine.

I’ve always subscribed to the more free spirited way of life.

“It’ll all work out, I’ll be fine.”

Which, is a very privileged view, I know.

What the last year has shown me though, is that you need to be prepared for anything. And one of the best ways to be prepared, is financially. My boyfriend’s job has healthcare, benefits, a pension, and job security – all things that have become even more valuable since the pandemic.

My job doesn’t have any of these – the downside of the many upsides of being self employed. It’s now the law, that all employers have to provide a workplace pension scheme for their eligible employees and pay into it – that shows how important it is to have some sort of plan for your future.

So, the time to sort my self-employed pension is now. Or, a few months ago. Hence, this Pension Bee review.

How much pension do you get in England?

If you pay your taxes and qualify for a state pension in England, you will currently get around £175.20 per week once you hit 66. At my age, the current retirement age is 68 – 32 years to go. We don’t know what the pension will be then, but we can predict it’ll be around the same value.

Could you survive on £700.80 a month?

Would you be happy, and warm, and, most importantly, have nice holidays?

I used to think having a pension was just a gamble that you’d live that long, and I wanted to see if I would first. I realise now that’s a pretty stupid attitude.

Who knows what illness or incapacitation is in my future? And even if it’s none, or it’s mild, I do NOT want to be worried about turning my heating on. I will want money for a comfortable life, and the only way to have that, is to get started on my self employed pension ASAP.

Now that I’ve sorted my private pension, I want to review PensionBee, to show you why I chose them, and why I decided they were the best choice for my self employed pension.

I am not an accountant, or pensions advisor – I’m a self employed creative who didn’t know much about pensions until a few months ago. I’m sharing my findings with this PensionBee review to help you save for your future. You put into a pension at your own risk.

Sign up to PensionBee using this link.

What is PensionBee?

PensionBee is a digital company, that will consolidate your pensions, or start a new self employed pension for you. Paying into PensionBee is a way to save for your future with low risk, and easy access to your money from 55.

“PensionBee is a leading online pension provider, helping you transfer your old pensions into one new plan, that you can easily manage online. We’re on a mission to make you pension confident by helping you take control of your pension savings and plan for a happy retirement. With PensionBee you can manage your pension like you manage your bank account: check your real-time balance, see your projected retirement income, and set up contributions and withdrawals from the palm of your hand.”

– PENSIONBEE

PensionBee Review

Why I signed up to PensionBee, put simply

One of the main reasons I signed up to PensionBee now, was to take advantage of the tax relief you get. For every £100 you put in a pension, the government will top it up by £25. Having a self employed pension is a way to get another £25 from the government, for your future, at no extra cost to you and tax free. This top up is one of the best things about saving for a pension.

To start this PensionBee review, let me take you through the main reasons why I chose them. It only takes a few minutes to sign up to a pension with PensionBee.

– They’re one of the few pensions providers who do specific self employed pensions.

– The PensionBee app was clear and straightforward.

– The PensionBee website was well set out and explained things in simple terms for anyone totally confused by pensions (me).

– You’re assigned your own ‘beekeeper’ to look after you and your transfers and contributions. This is an actual person who’s very helpful on emails.

– Once signed up, the desktop dashboard is very simple to understand.

– PensionBee has a 4.6 out of 5 rating on TrustPilot.

– You can get 25% of your pension out at the age of 55.

– You can nominate up to 4 benefactors should you pop your clogs before you come to take it out.

– You can manage your pension online, easily.

– You can add as much as you want, when you want, easily through the app.

– They automatically claim your 25% tax top up from HMRC, if you’re eligible.

– The founder is a 35-year-old woman, Romi Savova, who wanted to make pensions and saving easier for all.

“The company now has 102 employees, and while it may sound corny, Romi insists that “one of our unique values is love”.

So how does the company show love? “I really wanted to create a place where people can be themselves, whatever their gender, ethnicity or sexual orientation, ” she says.

“In big companies you have to hide who you are. [And] we have equal parental leave for mums and dads, with six months fully paid leave.”

– BBC NEWS, ‘The Woman Who Wants Everyone to Get a Pension‘

Self employed pension essentials

If you’re opening up a self employed pension with PensionBee you can start it off by moving your existing pensions over, or, by starting afresh.

Before you start up a new one…

Triple check with past employers before you decide you don’t have one!

“PensionBee analysis found that coronavirus increased the number of dormant pensions left behind by savers from an estimated 16.3 million in 2019 to over 21.5 million last year.”

– PENSIONBEE

Take control and claim your pensions!

I already had a very small pension with a company I worked at over 10 years ago. I’d tracked this small pension pot down a few years ago – one of the many unsuccessful times I’d promised myself I’d get a pension sorted. Having this information meant it was easy to set up the self employed pension with PensionBee and start saving right away.

I’d strongly recommend you get in touch with old employers to check if you paid into a pension, if you’re not sure. One of my friends, in her 60s, worked at a credit card company in her 20s, for a few months, and is receiving a sweet little pension pot from them every month. It was only when an old colleague got in touch that she even knew it was there.

Based on this I phoned round every company I’d ever worked for to double check I didn’t have any other pensions lying around.

No such luck, just the one.

How to move your pension to PensionBee

Your assigned ‘Beekeeper’ will do this for you. As you’ll see in this PensionBee review, PensionBee are very supportive and communicative during the whole process.

All you need to do is provide all the details you know. Any old pension account numbers will speed the process up and are easier for you to source than them, with old companies.

Armed with the details of old pensions, PensionBee transfers your old pensions into one new online plan, that you choose. Another plus for this PensionBee review.

“Just 24% of self-employed workers pay into a pension, causing millions to retire without adequate savings.”

– PENSIONBEE

Sign up to PensionBee using this link.

PensionBee transfer fees

So, what’s the cost of all this PensionBee goodness? Is PensionBee good value?

It’s totally free to transfer your pensions to PensionBee.

You will pay an annual management fee though. This is deducted from your pension on a daily basis.

If your pension is under £100,000, you’ll pay an annual fee of 0.5-0.95% depending on the pension you choose.

“If your pot size is larger than £100,000 we’ll halve the fee on the portion of your savings over this amount.”

– PENSIONBEE

If you keep in mind the fact that the government is giving you an extra 25% on all pension savings, then you’re still making 24.5-24.05% on every pound you put in that self employed pension pot.

And that, is a good deal.

No other savings will give you a 24% annual interest.

Depending on the type of pension you choose, you may also need to read up on transaction costs. These will be a max of 0.27% and PensionBee are very transparent about when they’d be charged. You can download their explanatory paper here if you think you’ll need to know about this.

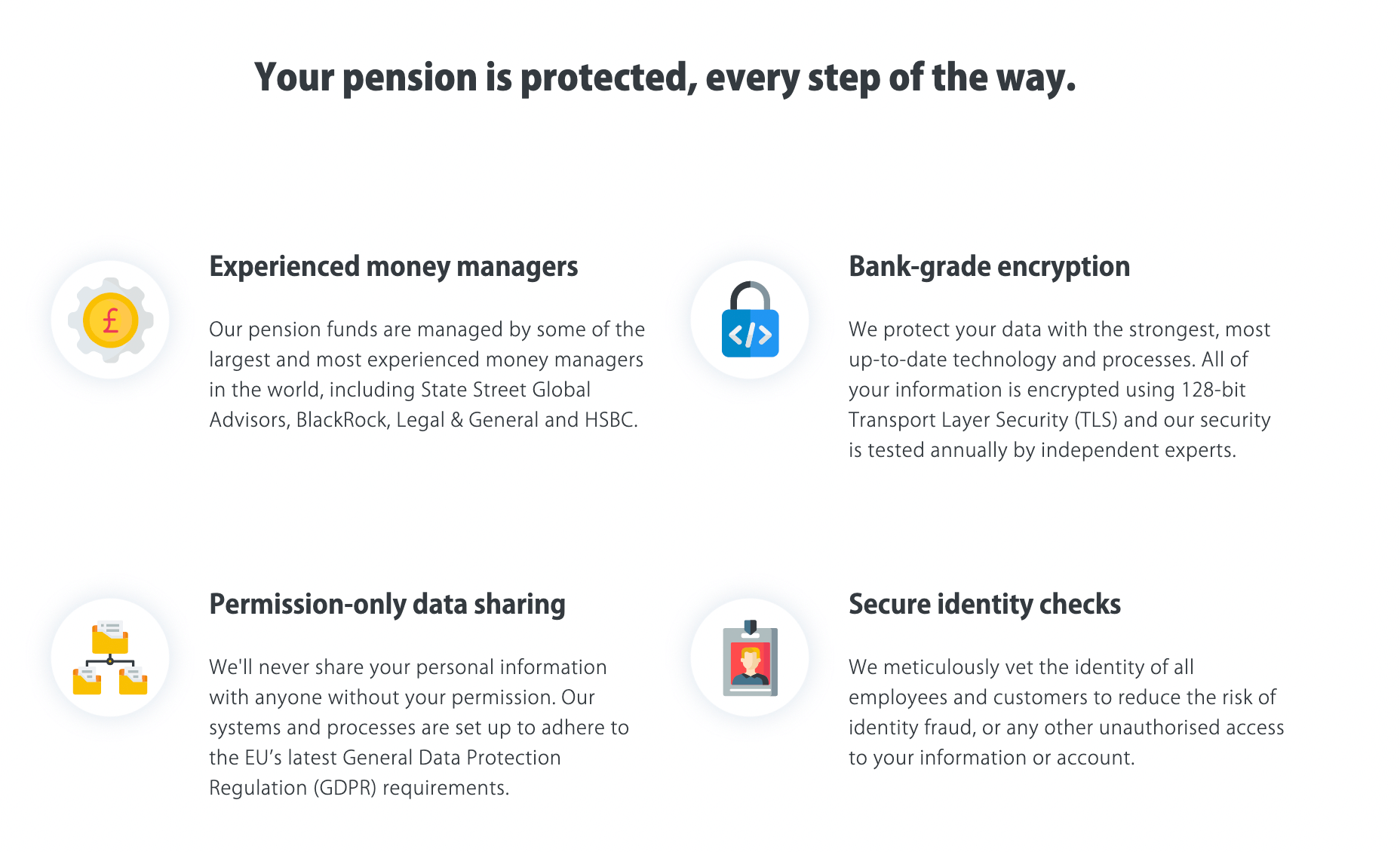

PensionBee review: Is PensionBee safe?

The official PensionBee line on this is…

“As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.”

– PENSIONBEE

All pensions, self employed or not, are investments. And investments can be risky.

One of the great things about PensionBee though, is that you can choose a pension based on how much you want to risk. If you love the thrill of the game, then you can invest big, and win big (or lose big). If you prefer to live life on the safe side, then you can invest in sure bets. The profit isn’t as much, but the loss isn’t either.

There’s more information on the PensionBee website about their commitment to security and safety, but I’ve screenshotted the highlights for you here.

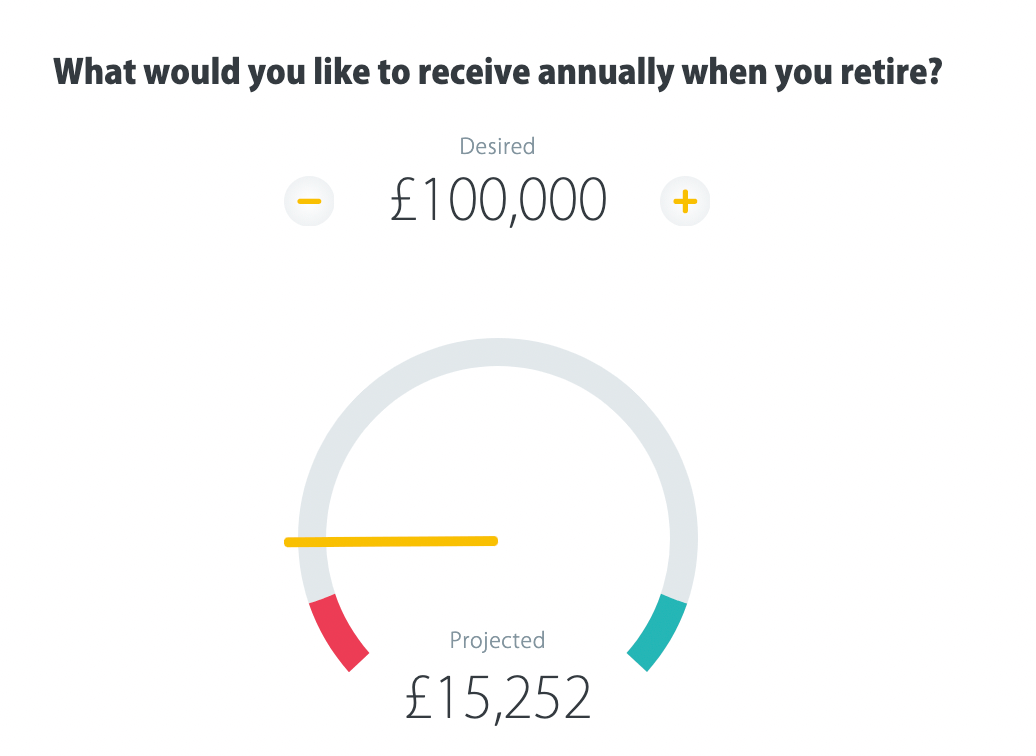

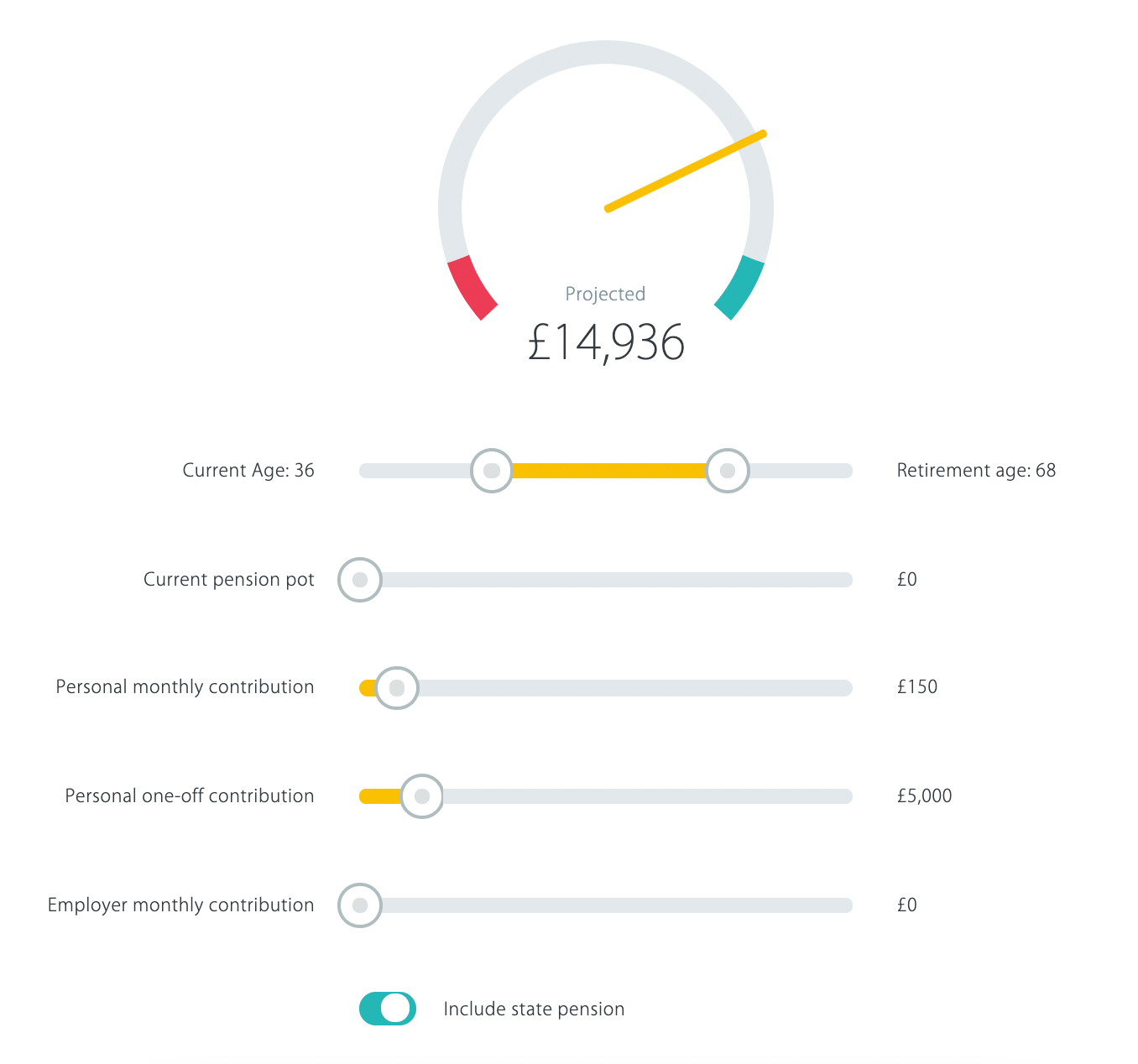

Pension Bee review: Pensions calculator

I’ve put in a small lump sum to my PensionBee pension, in addition to my old pension, to get me going and make the most of this year’s allowance. I’ve then set it up to pay in £150 a month by direct debit. It may not be a fortune but it’s a big step forward in actually saving for my future.

You can check out the PensionBee calculator here.

I think whatever you can start on, it’s a start – and that’s often the hardest bit. Hopefully I will be able to increase my payments as I go on.

Use the PensionBee pensions calculator to work out what you should be aiming for with your savings to reach your desired pension pot at your retirement age. If this doesn’t urge you into action to get saving for your retirement, nothing will!

How much can you put in your pension?

So, has this PensionBee review got you excited?

Ready to start saving?

Here are the details on how much you can start saving in your pension each year.

“You can save as much as you like towards your pension each year, but there’s a limit on the amount that will get tax relief.

The maximum amount of pension savings benefiting from tax relief each year is called the annual allowance.

The annual allowance for 2020-21 is £40,000 (or 100% of your earnings for the year if less). If you go over £40,000, you won’t get tax relief on further pension savings.

You can usually carry forward unused annual allowance from the previous three years.”

– MONEYSAVINGADVICE.COM

If you’ve got £40k for your pension pot, then great for you. But, if like me you’re nowhere near that much, then remember that every little counts. Start small and build yourself up as you go. The most important step is that first one!

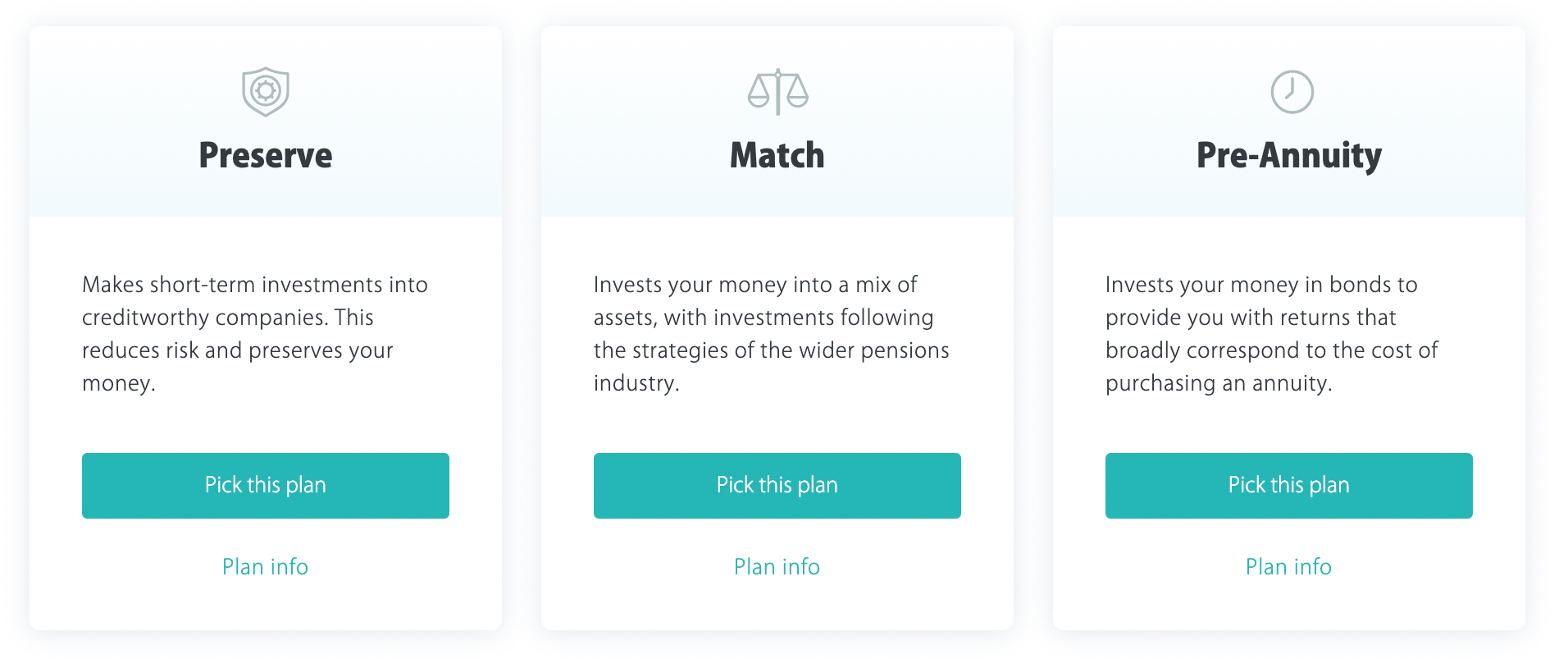

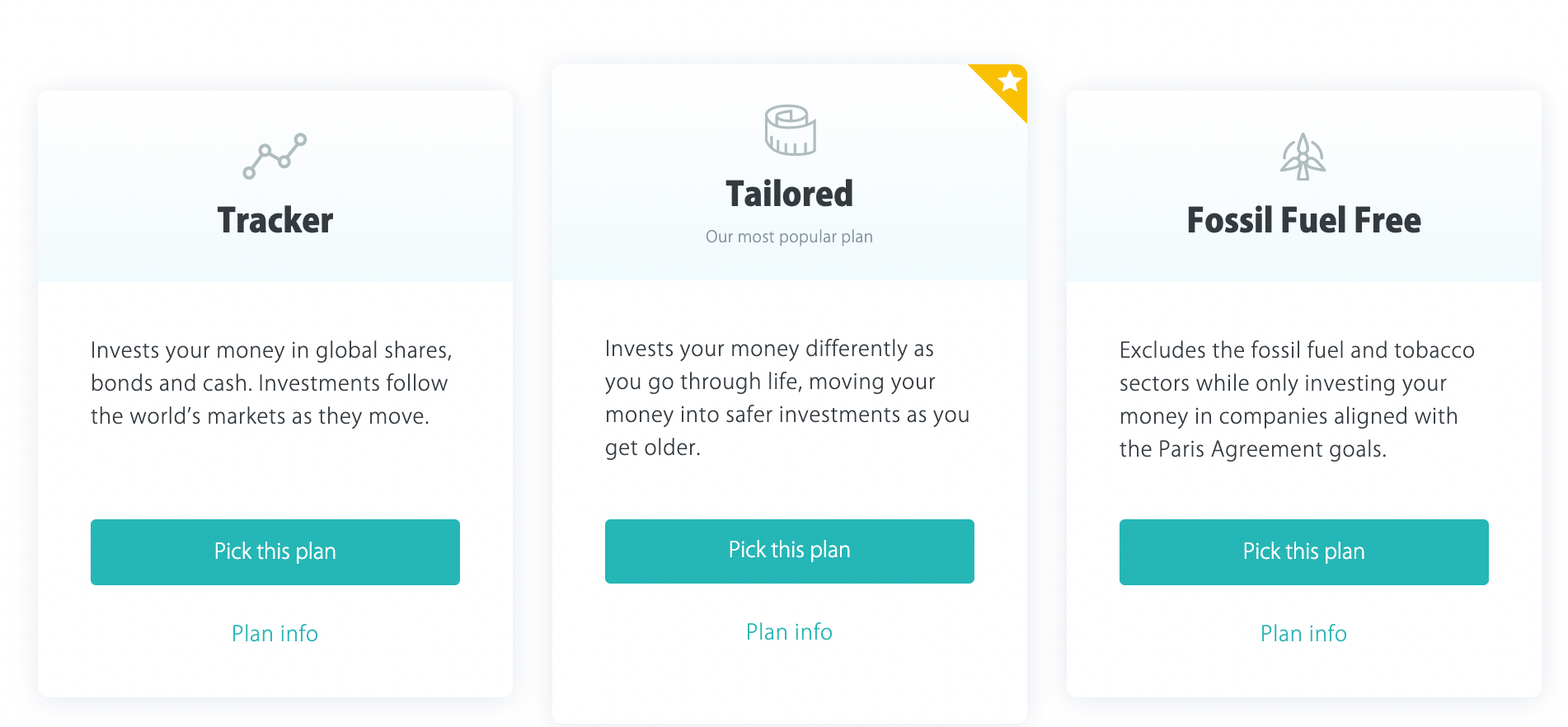

What kind of private pension can you get with PensionBee?

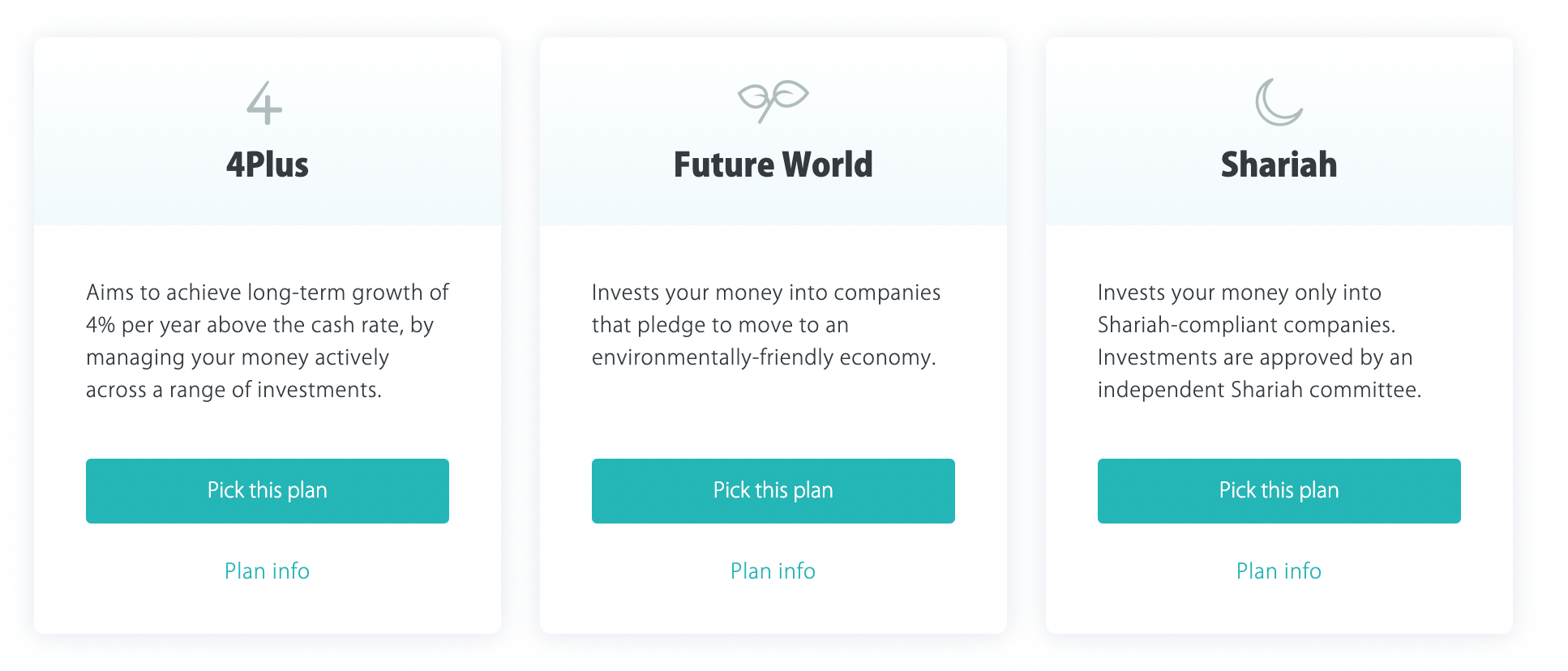

Within the PensionBee app, and on the desktop version, you can change the kind of pension you have at any time. There are different options depending on morals, beliefs and the level of risk you want to take.

The easy option, which is what I went for, is ‘Tailored’. This is also their most popular option as it automatically moves your money into safer assets as you grow older.

You can see all the PensionBee options below but you’ll need to use this link to learn more.

My PensionBee review disclaimer

Remember, I’m not qualified to give you financial advice. I’m a normal, self-employed person who wants to share my experience and help you save for your future.

PensionBee is a digital first company that is transparent and open with customers. Read through their site, and their reviews on other sites, and decide if it’s best for you. For me, it was by far.

Tax benefits of setting up a self employed pension

If you’re self employed and you set up a pension you will get tax relief for it. In fact, for every £100 you put in, you’ll get another £25 put in by the government. This is a great way to make your money work harder for you.

It’s hard to imagine me at my retirement age of 68. Who knows what I’ll be like?! I do know that I’ll want money though. I expect to be going on lots of holidays and drinking Champers for breakfast.

And as I’m sure you’ve learned from the nature of being self employed, if you have a vision, you have to work for it. You can’t rely on anyone else.

I intend to work hard on my pension, and have some money to spend. If the government can top this up by 25% then I am all for it.

I’d strongly advise you to look at this self employed pension calculator and see how much you can expect to get from your state pension, and when. Use this link to get set up with PensionBee.

I hope this PensionBee review has encouraged you to step up and start saving. You can thank me when you start drawing it as an OAP!

More PensionBee reviews

All these Pension Bee reviews were left on TrustPilot in the last week…

“I know I had several pensions dotted about over the past 20 odd years, so getting BEE to do all the work was great plus they found a pension I wasn’t aware existed so very pleased so far. I’m looking forward to being about to choose which assets to invest in and control what risks I’m willing to take to increase my pot over the next 20 odd years.”

– PHILLIP

“No fuss no hassle as very easy to do. Only a couple of bits of information needed but once ball gets rolling. Great work.”

– DARREN

“Made transferring my 2 pensions from previous workplaces into 1 account so simple and easy. Signed up and put the pension policy numbers in and PensionBee did the rest.”

– JAMES

“Sorted out pensions in minutes!

Sorting out my pensions has been on my to-do list for longer than I care to remember. I decided to try PensionBee and was thrilled that I was able to get it all sorted, so easily and clearly, within minutes. Amazing! Highly recommend.”

– OLIVIA

Sign up to PensionBee using this link.

Pension Bee review warning: As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.

SAVE THIS PENSION BEE REVIEW FOR LATER